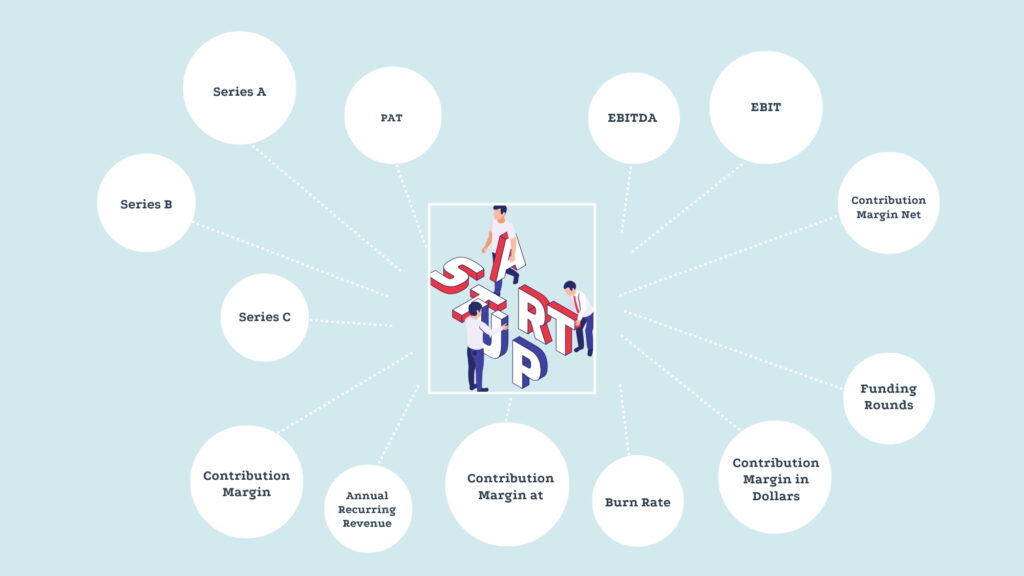

Ever felt like you’re eavesdropping on a different language when startup folks talk? PAT this, EBITDA that, Series A and CM#… sometimes you heard this on sharktank. iI’s a whirlwind of acronyms and financial jargon that can leave even seasoned business professionals scratching their heads. But fear not! Understanding these key startup keywords is crucial whether you’re an aspiring founder, an investor, or just curious about the exciting world of startups.

Today, we’re breaking down some of the most common and often confusing startup jargon, giving you the Rosetta Stone to navigate the startup lexicon. Let’s dive in!

Financial Must-Knows:

PAT (Profit After Tax) / Net Profit:

- Full Form: Profit After Tax (also often referred to as Net Profit or Net Income)

- Meaning: This is the bottom line! PAT represents the money a company has left over after paying all its expenses, including the dreaded taxes. It’s the true profit that belongs to the company and its shareholders.

- Why it Matters: PAT is the ultimate measure of profitability. Investors and stakeholders look at PAT to understand how much money a company is actually making. Sustained positive PAT is a sign of a healthy and sustainable business (eventually!).

- Basic Calculation:

Revenue – Cost of Goods Sold – Operating Expenses – Interest – Taxes = Profit After Tax (PAT)

Think of it as starting with all the money coming in (Revenue) and subtracting everything that goes out (Costs, Expenses, Interest, Taxes) to see what’s left at the end.’

EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization):

- Full Form: Earnings Before Interest, Taxes, Depreciation, and Amortization

- Meaning: EBITDA is a measure of a company’s operating profitability before accounting for financing decisions (Interest), government taxes (Taxes), and accounting write-downs (Depreciation & Amortization).

- Why it Matters: Startups often have high debt and significant capital expenditures (leading to depreciation). EBITDA is used to get a clearer picture of the core operational performance of the business, stripping away these potentially variable factors. It’s useful for comparing companies with different capital structures and tax situations. Investors often use it as a proxy for cash flow in early-stage, high-growth companies.

- Basic Calculation (Simplified):

Revenue – Cost of Goods Sold – Operating Expenses = Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) Essentially, it’s profit before the “non-operating” stuff.

EBIT (Earnings Before Interest and Taxes):

- Full Form: Earnings Before Interest and Taxes

- Meaning: EBIT is similar to EBITDA but includes Depreciation and Amortization. It measures a company’s operating profit before considering interest expenses and taxes.

- Why it Matters: EBIT is a step closer to net profit than EBITDA. It factors in the cost of using assets (Depreciation and Amortization), giving a more comprehensive view of operating profitability than EBITDA, but still isolates the business from financing and tax effects.

- Basic Calculation (Simplified):

Revenue – Cost of Goods Sold – Operating Expenses – Depreciation – Amortization = Earnings Before Interest and Taxes (EBIT) It’s EBITDA minus Depreciation and Amortization.

Funding and Investment Startup Jargon:

Series A, Series B, Series C… (Funding Rounds):

- Meaning: These terms refer to rounds of venture capital funding that startups typically raise as they grow. They are sequential (A comes before B, etc.).

- Why it Matters: Each series represents a different stage of startup growth and comes with different valuations and investment amounts.

- Seed Round: The very first external funding, usually from angel investors or early-stage VCs, to get the idea off the ground and build an initial product/service.

- Series A: The first significant round of institutional funding. Startups at this stage usually have some product-market fit and are looking to scale their operations, sales, and marketing.

- Series B, C, D… and Beyond: Subsequent rounds are for further scaling, geographic expansion, product development, acquisitions, and ultimately, preparing for a potential IPO (Initial Public Offering) or acquisition.

- Takeaway: Think of funding rounds as checkpoints in a startup’s journey. Each round aims to fuel the company to reach the next milestone and de-risk the investment for subsequent rounds.

Customer and Marketing Metrics:

CM:

- Full Form: Contribution Margin (sometimes referred to as Customer Margin, depending on context).

- Meaning: Contribution Margin represents the revenue remaining after deducting variable costs directly associated with producing and selling a product or service. It shows how much “contribution” each sale makes towards covering fixed costs and generating profit.

- Why it Matters: CM is crucial for understanding unit economics. It tells you if each sale is profitable at its core. A positive CM is essential for scalability. If your CM is negative, you’re losing money with every sale!

- Basic Calculation (Simplified):

Selling Price per Unit – Variable Cost per Unit = Contribution Margin per Unit

- Meaning: These variations are not standard industry terms but are often used internally within companies to represent different levels or calculations of Contribution Margin. They are company-specific shorthand.

- Possible Interpretations (You’d need company context to be sure):

- CM@ (Contribution Margin at…): Could mean Contribution Margin at a specific stage (e.g., CM@Marketing, CM@Sales) or for a specific product line or customer segment.

- CM# (Contribution Margin Net…): Might represent Contribution Margin after considering specific overheads or allocations that aren’t strictly “variable costs” but are closely tied to a particular area of the business.

- CM$ (Contribution Margin in Dollars): Could simply indicate that the Contribution Margin is being expressed in dollar terms rather than as a percentage.

- Why They Matter: While the exact meaning is company-dependent, these variations highlight the importance of breaking down Contribution Margin to understand profitability at different levels of the business. It shows a focus on granular unit economics analysis.

- Understanding: If you encounter these terms, always ask for clarification within the specific company context to understand exactly what they represent.

This is just a starting point! The startup world is full of more jargon, but understanding these foundational terms will significantly improve your comprehension. Remember, the key is not just memorizing definitions, but understanding why these metrics and concepts are important for building and analyzing successful startups.

Want to learn more startup jargon? Drop your questions in the comments below and let’s decode the startup language together!