The diamond industry, known for its timeless allure and enduring value, is a captivating world of luxury, innovation, and global connections. From the depths of the earth to the glittering displays of jewelry stores, diamonds embark on a remarkable journey that touches numerous countries and impacts diverse economies. This blog delves into the heart of the diamond industry, exploring its current state, international market dynamics, and the challenges and opportunities that lie ahead.

A History Carved in Time

The story of diamonds begins in ancient India, where these mesmerizing gems were first discovered around 800 BC. Initially valued for their strength and believed to possess supernatural powers, diamonds were used as talismans and adornments. Over time, their allure spread to ancient Rome and Greece, where they were considered tears of the gods or splinters of falling stars.

By the Middle Ages, diamonds had become a symbol of wealth and power among European royalty and nobility. The tradition of diamond engagement rings began in 1477 when Archduke Maximilian of Austria presented one to Mary of Burgundy. The diamond trade flourished in Venice, with skilled jewellers cutting and polishing these precious stones.

The discovery of diamond mines in Borneo and Brazil in the 18th century further fuelled the industry’s growth. However, it was the discovery of diamonds in South Africa in the late 19th century that truly revolutionized the diamond world. The Kimberley Mine, opened in 1871, triggered a diamond rush and established South Africa as the world’s leading diamond producer.

The 20th century saw the rise of De Beers Consolidated Mines, founded by Cecil Rhodes, which established a near-monopoly over the global diamond trade. De Beers controlled diamond prices and supply, shaping the industry for decades.

The Diamond Industry in 2025: A Sparkling Landscape

The global diamond market has demonstrated consistent growth over the years, with a compound annual growth rate (CAGR) of 3.70%. In 2023, the market value reached USD 101.9 billion, and it is projected to climb to USD 105.2 billion in 2024 and further to USD 110.1 billion in 2025. This growth is driven by several factors, including increasing consumer demand for diamond jewellery, advancements in diamond cutting and polishing technologies, and a growing preference for ethically sourced diamonds.

The global diamond production volume has shown significant fluctuations between 2015 and 2025. The peak production was observed in 2017, with a notable rise to 152.1 million carats. However, forecasts indicate a decline in the subsequent years, with production expected to fall to 129.8 million carats in 2023, 128.9 million carats in 2024, and further to 124.6 million carats by 2025.

The market is segmented into natural and synthetic diamonds. In 2023, natural diamonds accounted for USD 65.22 billion, while synthetic diamonds reached USD 39.98 billion. By 2025, these figures are expected to rise to USD 68.26 billion and USD 41.84 billion, respectively.

The jewellery and ornaments segment dominates the diamond market, holding a commanding market share of 65%. This highlights the enduring popularity of diamonds in jewellery, particularly for engagement rings, earrings, and necklaces.

G7 Diamond Protocol and Supply Chain Disruptions

In 2024, the G7 Diamond Protocol shook up the diamond industry, creating a profound impact on the global diamond supply chain. This protocol, aimed at restricting the trade of diamonds from certain regions, has led to increased scrutiny and stricter regulations in the diamond trade. Additionally, the industry has faced supply chain disruptions due to geopolitical factors, labour shortages, and the ongoing effects of the COVID-19 pandemic. These disruptions have impacted shipping timelines, increased operational costs, and created uncertainty in the market.

Reimagining the Natural Diamond Narrative

In recent years, the narrative around natural diamonds has sometimes struggled to compete with more affordable lab-grown alternatives. However, the industry is actively working to reimagine the narrative around natural diamonds and reignite consumer interest. This involves emphasizing the unique qualities of natural diamonds, such as their rarity, enduring value, and emotional significance. By highlighting the story behind each natural diamond, its journey from the depths of the earth to a piece of jewellery, the industry aims to connect with consumers on a deeper level and reinforce the value of these timeless gems.

Enhanced Trust and Transparency

Transparency is becoming increasingly important in the diamond industry, as consumers demand more information about the origin and journey of their diamonds. To build trust, the industry is implementing various measures to enhance transparency, such as third-party certifications, blockchain technology for traceability, and educational campaigns for consumers. By providing verifiable information about a diamond’s origin, ethical sourcing, and production process, the industry aims to empower consumers to make informed choices and foster confidence in the integrity of the diamond supply chain.

Advanced Technology Integration

Technology is playing a crucial role in shaping the diamond industry, from enhancing efficiency and accuracy in diamond cutting and grading to improving transparency and traceability in the supply chain. Automated and AI-based grading technologies are enabling faster and more reliable assessments of diamond quality, while blockchain technology is being used to track the origin and journey of diamonds from mine to market. These technological advancements are benefiting both producers and consumers, ensuring higher quality products, greater transparency, and increased trust in the diamond industry.

Understanding the Economic Potential of Known Kimberlites

While thousands of kimberlites, the geological formations that host diamonds, have been discovered worldwide, the challenge lies in understanding their economic potential. Not all kimberlites contain diamonds in sufficient quantities or quality to be economically viable for mining. To address this challenge, the industry is investing in better science and technology to evaluate the potential of known kimberlites and identify new diamond resources. This involves advancements in geological exploration, geophysical surveying, and data analysis to assess the diamond content and quality within kimberlites and determine their viability for mining.

International Diamond Hubs: A Global Network

The diamond industry thrives on a complex network of international connections, with various countries playing crucial roles in mining, cutting, polishing, and consuming these precious gems.

USA

The United States is the world’s largest consumer of diamonds. Consumer demand in the USA is influenced by economic conditions, social trends, and ethical considerations. The USA actively participates in the Kimberley Process Certification Scheme, which aims to eliminate the trade in conflict diamonds. The United States has a distinct responsibility for heading international efforts to curb the market in conflict diamonds, as it is the largest consumer of diamonds in the world and a leader in the fight against terrorism.

The Clean Diamond Trade Act (CDTA), passed in 2003, prohibits the “importation into, or exportation from, the U.S. of any rough diamond, from whatever source, unless the rough diamond has been controlled through the Kimberley Process Certification Scheme (KPCS).”This act formalizes the US’s participation in the Kimberley Process and demonstrates its commitment to ensuring that diamonds traded in the US are conflict-free.

In 2019, the US government proposed a plan to require full origin disclosure for all items in jewellery, although this plan did not materialize. However, in October 2024, the US Customs and Border Protection (CBP) announced new import requirements that oblige companies to state the “country of mining” when importing diamonds from April 2025. These new rules aim to enhance traceability in the diamond supply chain and enforce sanctions on diamonds from certain regions.

However, these new requirements have been met with criticism and confusion due to a lack of clarity regarding carat sizes, evidence requirements, and self-certification. The Jewellers Vigilance Committee (JVC) has expressed concerns about the unclear nature of the documents and the need for more detailed guidance from CBP.

Despite these challenges, the new US import requirements reflect the ongoing efforts to improve transparency and traceability in the diamond trade and ensure that diamonds entering the US market are ethically sourced.

| Age Group | Percentage of people who have a preference for diamonds when receiving jewelry |

|---|---|

| 16-24 | 53.60% |

| 25-34 | 51.12% |

| 35-44 | 55.43% |

| 45-54 | 52.87% |

| 55+ | 45.16% |

Canada

Canada is the world’s third-largest producer of rough diamonds by value and volume. In 2019, Canadian mines produced 18.6 million carats of rough diamonds valued at $2.25 billion. Canadian diamonds are known for their high quality and are often favoured for their ethical sourcing and environmental responsibility.

The first discovery of diamonds in Canada occurred in 1991 at Point Lake near Lac de Gras in the Northwest Territories. In October 1998, the Ekati mine near Lac de Gras became the first diamond mine in Canada to begin production. Since then, several other mines have been established in the Canadian Shield, contributing to Canada’s position as a leading diamond producer.

Canadian diamonds are engraved with a small maple leaf symbol to ensure their origin and are sought after by jewellers due to their ethical sourcing and environmental responsibility. Canada’s commitment to responsible mining practices and strict adherence to the Kimberley Process further enhances the appeal of Canadian diamonds in the global market.

Canada’s total primary exports of diamonds were valued at $2.21 billion in 2019. The main export destinations for Canadian diamonds are India, Belgium, and Botswana. The estimated value of Canada’s total primary imports of diamonds was $466 million in 2019. However, the Canadian diamond industry has faced challenges in recent years, with production volume decreasing in 2019 due to the depletion of certain mines and the lower grade of ore being extracted. Additionally, permitting challenges and the lack of infrastructure in remote regions have hindered the industry’s growth. Despite these challenges, there is potential for recovery of Canada’s diamond industry through strategic investments in infrastructure, streamlined permitting processes, and innovation in exploration and processing technologies. Global market dynamics, such as rising diamond prices and increased demand for ethically sourced gems, could also benefit Canada’s diamond industry.

Africa has a long and complex history with the diamond industry. While the continent is a significant source of diamonds, it has also faced challenges related to conflict diamonds and ethical concerns. However, initiatives like the Kimberley Process have helped to address these issues and promote responsible diamond mining practices. The discovery of diamonds in South Africa in 1867 radically changed the global diamond supply and the perception of diamonds. The first diamond discoveries were alluvial, but by 1869, diamonds were found in kimberlite, a type of rock named after the mining town of Kimberley. The diamond rush in South Africa led to the establishment of large mining companies and the consolidation of the industry. However, the history of diamond mining in South Africa is also intertwined with colonialism and exploitation. The discovery of diamonds and goldfields in the late 19th century led to British imperialist interventions and the transformation of South Africa from an agrarian society to an industrial economy under British control. Today, several African countries are major diamond producers, including Botswana, South Africa, and Angola.

Botswana is the largest diamond-producing country in Africa and the world, with the Jwaneng and Orapa diamond mines being the first and second biggest in the world, respectively. South Africa has been a consistent producer for decades, with seven diamond-producing mines, including Venetia, which is jointly owned by De Beers. Angola is the third-largest diamond-producing country in Africa, with the Catoca diamond mine being the fifth biggest in the world. Despite the progress made in addressing ethical concerns, challenges remain in ensuring that all diamonds from Africa are ethically sourced and conflict-free. The Kimberley Process has been criticized for its loopholes and its inability to address issues beyond conflict diamonds, such as environmental impact, human rights abuses, and fair labour practices. The illegal mining and selling of diamonds by rebel groups in Africa have funded armed conflicts and caused immense suffering to innocent civilians. This issue highlights the need for continued efforts to combat the trade in conflict diamonds and promote responsible mining practices that benefit local communities and protect human rights.

Europe Europe plays a vital role in the diamond industry, with Antwerp, Belgium, being recognized as the diamond capital of the world. Antwerp has a rich history in diamond trading and cutting, dating back to the 15th century. The city is home to the Antwerp World Diamond Centre (AWDC), which represents and coordinates the Antwerp diamond sector. The European diamond market is projected to reach a revenue of US$ 6,407.3 million by 2030, with a CAGR of 3.2% from 2025 to 2030. In 2024, the market generated a revenue of USD 5,337.6 million. The jewelry and ornaments segment is the largest revenue-generating application in the European diamond market.

| Name | Profile | Employees | HQ | Website |

|---|---|---|---|---|

| Gem Diamonds Ltd | View profile | 1401 | 2 Eaton Gate, London, United Kingdom, SW1W 9BJ | www.gemdiamonds.com |

| Arctic Canadian Diamond Company | View profile | 501-1000 | Calgary, Alberta, Canada, North America | www.ddmines.com |

| Mountain Province Diamonds Inc | View profile | 13 | 151 Yonge Street, Suite 1100, Toronto, ON, Canada, M5C 2W7 | www.mountainprovince.com |

| De Beers | View profile | 1001-5000 | London, England, United Kingdom, Europe | www.debeers.com |

| Alrosa | View profile | 10001+ | Mirny, Krasnodar, Russian Federation, Europe | www.alrosa.ru |

| Lucara Diamond Corp | View profile | 592 | 1250 Homer Street, 502, Vancouver, BC, Canada, V6B 2Y5 | www.lucaradiamond.com |

| Trans Hex | View profile | 251-500 | Cape Town, NA – South Africa, South Africa, Africa | www.transhex.co.za |

| Petra Diamonds Ltd | View profile | 3042 | 2 Church Street, Clarendon House, Hamilton, Bermuda, HM11 | www.petradiamonds.com |

Germany’s colonial activities in Southwest Africa (present-day Namibia) in the early 20th century had a significant impact on the world diamond market. The German colonial government perpetrated genocide against the indigenous Nama and Herero peoples while exploiting the region’s diamond resources. This historical context highlights the ethical concerns surrounding diamond mining and the need for responsible practices.

Antwerp’s rise as a diamond centre began in the 15th century, when it became a major trading hub for diamonds from India. The invention of the scaif, a diamond polishing tool, in 1476 by Lodewyk van Berken further solidified Antwerp’s position in the diamond industry. Today, Antwerp remains a crucial player in the global diamond trade, with the Antwerp Diamond District being the largest diamond centre in the world.

Amsterdam also played a significant role in the diamond trade for over 300 years, with its Jewish community being instrumental in the industry’s development. However, Amsterdam’s dominance declined in the 20th century, with Antwerp and other centres taking a more prominent role.

The European Union (EU) is a major centre for diamond trade and has been actively involved in the Kimberley Process since its inception. The EU has implemented regulations to ensure that rough diamonds imported or exported within the EU adhere to the Kimberley Process Certification Scheme.

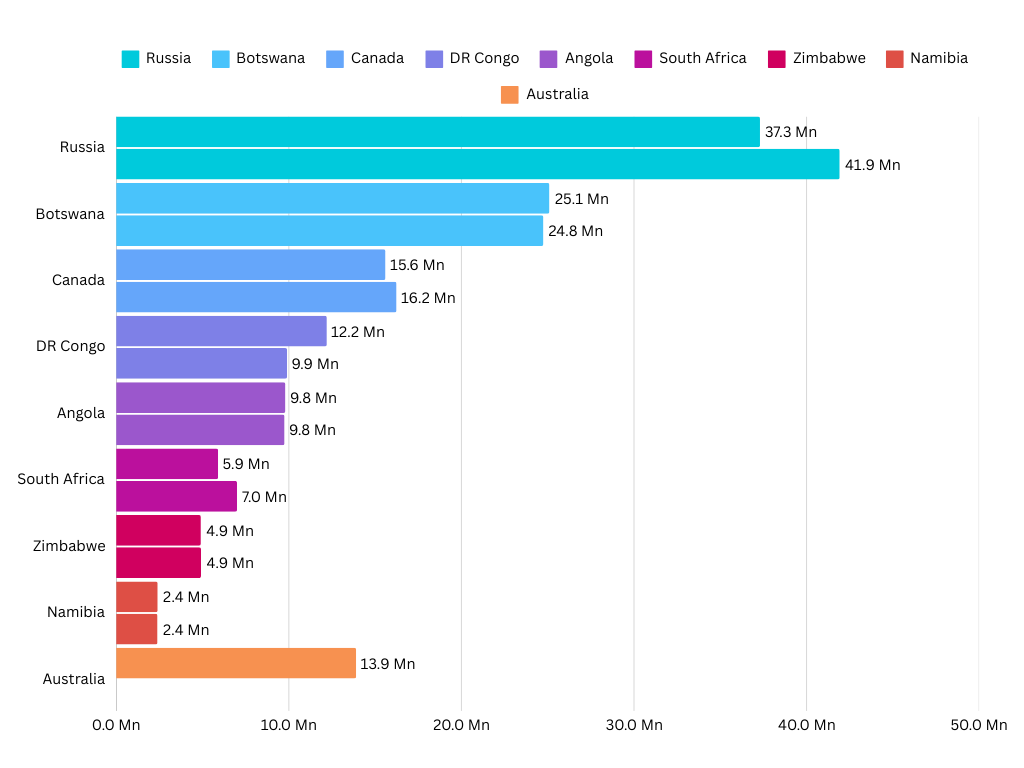

Major Diamond Mining Countries

The diamond mining landscape is dominated by a few key players:

These countries contribute significantly to the global diamond supply, with Russia leading the pack in terms of production volume. Botswana, while second in volume, is known for producing high-value diamonds. Canada’s diamond industry is characterized by its commitment to ethical sourcing and environmental responsibility.

Australia is the leading producer of coloured diamonds, particularly pink, purple, red, and yellow diamonds. The Argyle mine, owned and operated by Rio Tinto, is the largest diamond mine in Australia and was a significant source of diamonds until its closure in 2020.

Earth is divided into two separate diamond-producing bands: the Northern band and the Southern band. The Northern band consists of Canada and Russia, while the Southern band includes Botswana, South Africa, Namibia, and Australia. The central band of the Earth also produces diamonds in countries such as Ivory Coast and Sierra Leone in Africa, and Venezuela and Brazil in South America.

Diamond Cutting and Polishing Centres

The transformation of rough diamonds into polished gems is a meticulous art that requires skilled craftsmanship. India dominates the diamond cutting and polishing industry, holding around 90% of the world market share. Surat, in particular, is a major hub for diamond processing. Other important diamond centres include the Chinese cities of Guangzhou and Shenzhen, as well as New York City and Amsterdam.

Historically, diamond-cutting centres have been located in the Netherlands, South Africa, the United States, and Israel. However, due to the lower cost of labour, India has become the dominant player in the diamond cutting and polishing industry.

Diamond Markets and Consumer Demand

The United States, China, and India are the largest diamond markets in the world. Consumer demand is influenced by factors such as economic conditions, cultural preferences, and ethical considerations. The rise of e-commerce has also impacted diamond retail, with consumers increasingly comfortable purchasing high-value items online.

As of the latest data, consumer preference for diamond types shows a strong inclination towards natural diamonds, which are favoured by 84% of consumers. In contrast, lab-grown diamonds are preferred by 16% of consumers.

Shifting Global Dynamics

In 2024, India surpassed China in natural diamond consumption, becoming the second-largest market after the US. This shift in global dynamics highlights the growing importance of the Indian market and the need for the diamond industry to adapt to changing consumer preferences and regional trends.

Personalization and Customization

Consumers are increasingly seeking personalized and customized diamond jewellery, particularly in the high-end segment. This trend reflects a desire for unique and bespoke pieces that reflect individual style and preferences. Brands are responding to this demand by offering a wider range of customization options, collaborating with influential designers, and creating “one-of-a-kind” pieces that cater to the desire for individuality.

Branded Jewelry Growth

Branded jewellery is expected to grow in the fine jewellery segment, with its share projected to increase from 20% to 25-30% by 2025. This trend reflects the increasing influence of brands in the diamond jewellery market and the growing consumer preference for recognizable names and established reputations.

E-commerce Growth in Diamond Retail

The rise of e-commerce is rapidly changing diamond retail, with consumers increasingly comfortable buying big-ticket items online. McKinsey research shows that online purchases of fine jewellery are expected to increase at a CAGR of 9 to 12 percent from 2019 to 2025, implying that 18 to 21 percent of fine jewellery transactions will be made through digital platforms. This trend highlights the growing importance of online platforms in the diamonds trade and the need for retailers to adapt to changing consumer behaviour and preferences.

Holistic Consumer Experiences

Consumer expectations have evolved beyond product quality, brand identity, and price point. People now expect brands to cater to their emotional and social needs and values. In response, diamond retailers are creating holistic consumer experiences that go beyond the traditional transaction. This involves storytelling that connects the product with the buyer’s personal journey, milestones, or social causes, personalized services that cater to individual needs, and online platforms that provide immersive and engaging experiences.

The Rise of Synthetic Diamonds

Synthetic diamonds, also known as lab-grown diamonds, have emerged as a significant force in the diamond industry. These diamonds are created in laboratories using advanced technology that replicates the natural diamonds formation process. They are chemically and physically identical to natural diamonds but are often more affordable and considered more ethical and sustainable.

The market for lab-grown diamonds has experienced substantial growth, with its value projected to reach USD 51.9 billion by 2030. This growth is driven by increasing consumer awareness of the ethical and environmental concerns associated with mined diamonds, as well as the affordability and accessibility of lab-grown alternatives.

Impact of LGDs on Natural Diamond Prices

The affordability of lab-grown diamonds has put downward pressure on natural diamond prices, creating a challenge for the natural diamond industry. As consumers become more aware of the cost-effectiveness and ethical advantages of LGDs, the demand for natural diamonds may decrease, leading to price adjustments in the market.

Rough lab grown diamonds

Rough natural diamonds

Lab-Grown Diamonds and Fancy Shapes

In 2025, the LGD market is expected to diversify with more fancy shapes and higher demand for these products. As fancy lab-grown diamonds become more popular, diamonds grading technologies for LGDs will continue to develop and refine to support sales with high-quality diamonds reports.

Price Stabilization of LGDs

Lab-grown diamonds pricing is expected to stabilize in 2025, with potential slight increases in fancy shapes and colours like yellow, blue, and pink. This stabilization is attributed to increased efficiency and production capacity in the LGD industry.

Ethical and Sustainability Concerns

The diamonds industry has faced scrutiny over ethical and sustainability concerns, particularly regarding conflict diamonds, environmental degradation, and labour exploitation. However, initiatives like the Kimberley Process Certification Scheme and the Responsible Jewellery Council (RJC) have been implemented to address these issues and promote responsible practices.

Consumers are increasingly demanding ethically sourced diamonds, with a growing preference for transparency and sustainability in the diamonds supply chain. This has led to a greater focus on responsible mining practices, environmental protection, and fair labour standards.

ESG Factors and Consumer Demand

Rising awareness of ESG (environmental, social, and governance) factors is influencing consumer demand for diamonds. Consumers are increasingly concerned about the ethical and environmental implications of their purchases, and this is driving the demand for responsibly sourced diamonds with a minimal negative impact.

Sustainability-Influenced Sales

Sustainability-influenced sales in fine jewellery are expected to increase three to four times over from 2019 to 2025. This trend highlights the growing importance of sustainability as a factor in consumer purchasing decisions and the increasing demand for ethically sourced diamonds.

Traceability and Country of Origin

Traceability and country of origin are becoming increasingly important for diamonds, as consumers demand verifiable information about the journey of their diamonds from mine to market. This demand is driven by concerns about ethical sourcing, conflict diamonds, and the environmental impact of mining.

Digital Transparency and Traceability

Industrial players are increasingly using digital transparency software, such as blockchain, to enable tracking and address difficulties in transparency due to the fragmented value chain, especially for smaller stones. Blockchain technology provides a secure and transparent way to record and verify the origin and movement of diamonds throughout the supply chain, enhancing trust and accountability in the industry.

Future ESG Requirements

Future customer ESG requirements in the diamond industry could include mine safety, sustainable water use, and community involvement, especially given periodic news on the effect of diamonds mines on workers and communities. These evolving expectations reflect the growing importance of responsible mining practices and the need for the diamond industry to address social and environmental concerns throughout the supply chain.

Artisanal and Small-Scale Mining (ASM)

Artisanal and Small-Scale Mining (ASM) is a significant aspect of diamonds mining, particularly in developing countries. However, ASM presents challenges for the diamond industry due to concerns about ethical sourcing, environmental impact, and the potential for conflict diamonds.

A Sparkling Future?

The diamond industry is at a crossroads, facing both challenges and opportunities. The rise of synthetic diamonds, increasing consumer awareness of ethical and sustainability concerns, and evolving market dynamics are reshaping the industry. While challenges remain, the diamond industry is adapting and innovating to ensure a more responsible and sustainable future. By embracing ethical practices, promoting transparency, and investing in sustainable solutions, the diamond industry can continue to sparkle for generations to come.

Emerging Opportunities

Despite the challenges, the diamond industry has several emerging opportunities for growth and innovation. The demand for fancy-coloured diamonds is expected to surge, offering lucrative opportunities for wholesalers and retailers. New markets, such as the UAE and other Asian regions, are also becoming hotspots for diamonds trade, providing growth potential for savvy businesses. By capitalizing on these emerging opportunities, the diamond industry can diversify its offerings, expand its reach, and cater to evolving consumer preferences. This will contribute to the long-term viability and sustainability of the industry, ensuring that diamonds continue to shine brightly in the global market.

Useful Blogs

- From Lab Coats to Luxury: Unveiling the Magic of CVD and HPHT Diamond Growth Technologies

- The Lab-Grown Diamond Dilemma: Why Are Indian Jewellers Holding Back?

- The ultimate guide to diamond and gemstone

- The Allure of Natural Diamonds: A Journey From Earth’s Depths to Your Finger

- India’s Diamond Industry: From history to future